TechTAXCelerate: Unleashing the Future of Tax Technology

A Webinar Series

December 16-19, 2024

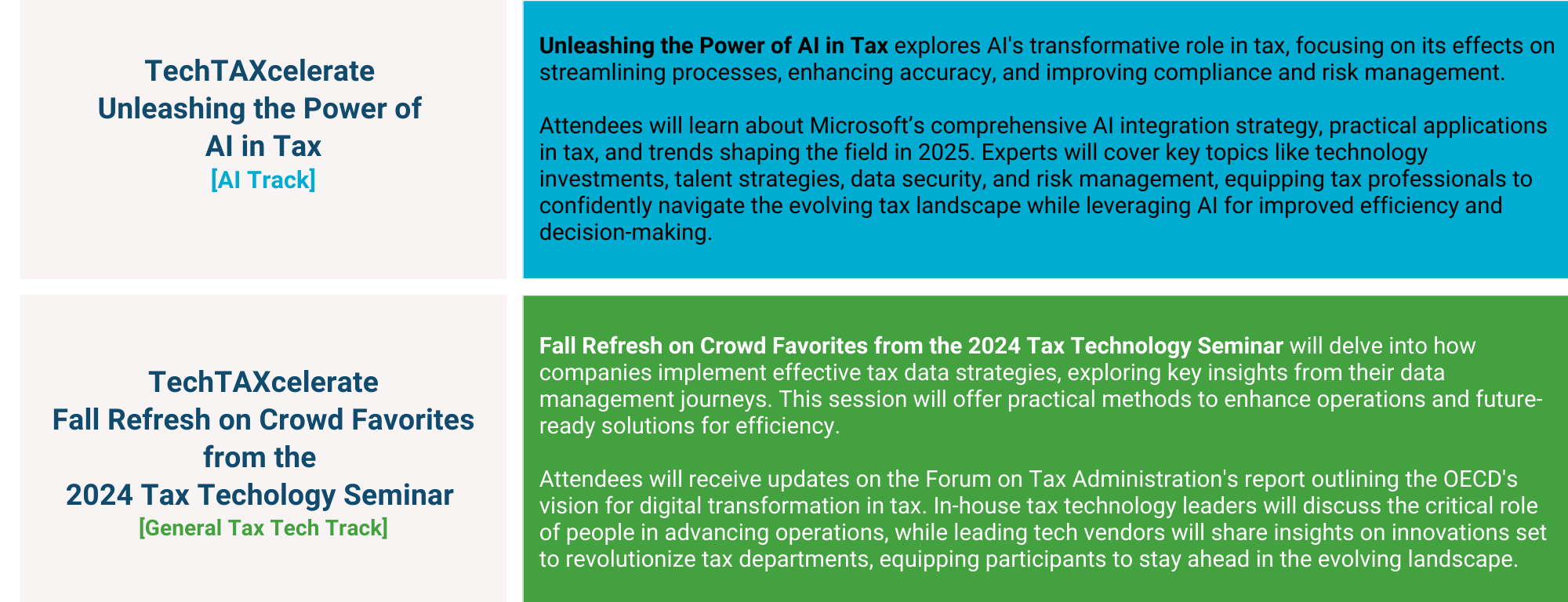

TEI’s 2024 webinar series TechTAXcelerate: Unleashing the Future of Tax Technology presents eight insightful sessions organized as an AI Track and a General Tax Tech Track on the transformative role of AI and effective tax data strategies applied in modern tax practice.

Discover how companies enhance their tax operations through practical strategies, future-ready solutions, and lessons learned from their data management journeys. Gain valuable insights into the OECD's vision for digital transformation in tax administration and its implications for tax professionals and taxpayers. Learn from in-house tax technology leaders about the critical role of people in technology strategies and hear from leading technology vendors on the next wave of innovations to revolutionize tax departments. This webinar series will equip participants with the knowledge to navigate the evolving landscape and optimize tax processes.

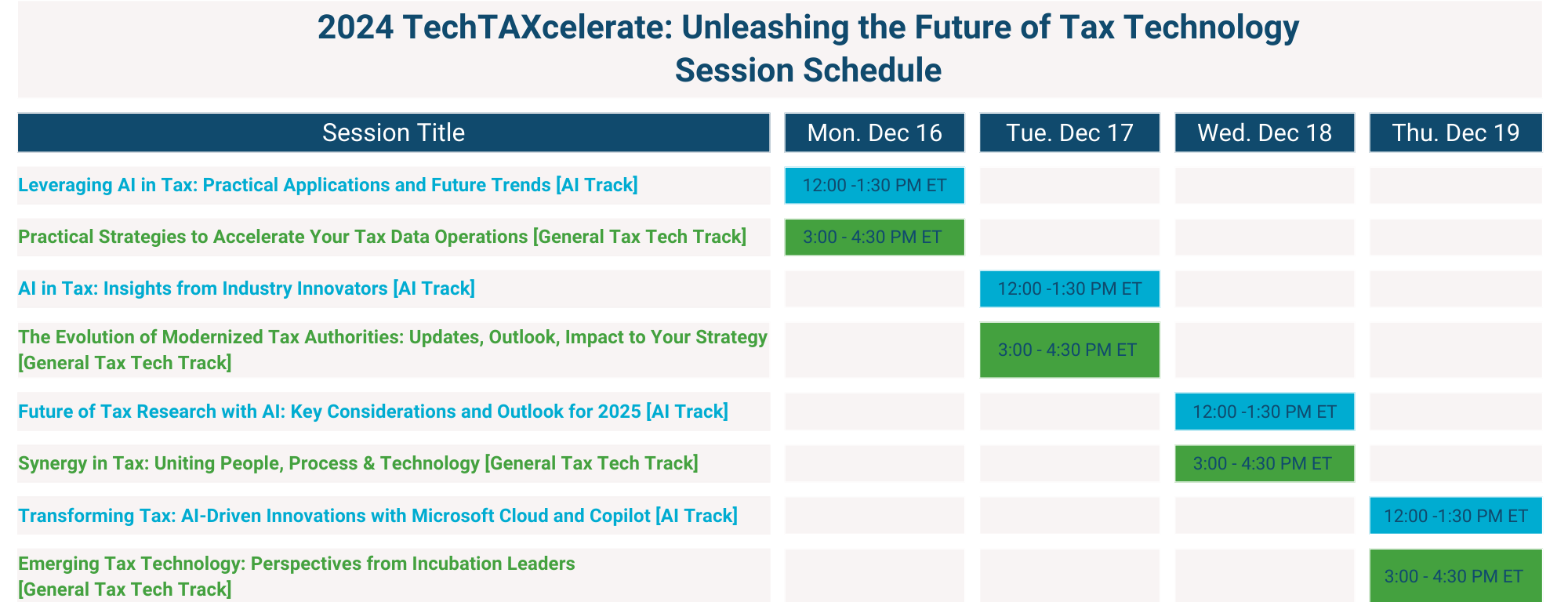

The webinar series offers multiple registration options. While most attendees will opt to attend the full webinar series, we have also created options to attend just the AI Track or the General Tax Tech Track, or you may choose to attend individual sessions. Please see the table below for details on the dates and times of the sessions.

Session Descriptions

Leveraging AI in Tax: Practical Applications and Future Trends [AI Track]

12/16/24 - 12:00-1:30 pm ET

This session explores the evolving role of AI in tax beyond research tools. Discover how AI is transforming tax departments by streamlining processes, improving accuracy, and enhancing functions like compliance, reporting, predictive analysis, and risk management. We’ll also discuss future trends and the potential of AI to revolutionize tax practices. Gain valuable insights on implementing AI to boost efficiency and decision-making in your tax department. This session prepares tax professionals for the technological advancements shaping the future of tax.

Practical Strategies to Accelerate Your Tax Data Operations [General Tax Tech Track]

12/16/24 - 3:00-4:30 pm ET

Join us to learn how companies are successfully implementing their tax data strategies. We’ll explore key decision points and the thought processes behind them. This session will cover:

- Lessons Learned: Insights from the data management journey of various companies.

- Practical Strategies: Effective methods to enhance your tax data operations.

- Future-Ready Solutions: Discover solutions to build a robust foundation for your tax data operations, making them efficient today and prepared for tomorrow.

Gain valuable knowledge to elevate your tax data operations and stay ahead in the evolving landscape.

AI in Tax: Insights from Industry Innovators [AI Track]

12/17/24 - 12:00-1:30 pm ET

Join us for an enlightening session where leading experts in technology and tax share their insights on the current and future landscape of AI in tax. This session will delve into the transformative impacts of AI on various aspects of tax operations and strategy. Hear from thought leaders as they discuss the “now and next” of AI in tax, covering critical topics such as:

- Technology Investments: Understand how AI is driving new investments in tax technology and reshaping the tools and platforms used by tax professionals.

- Talent Strategy: Explore how AI is influencing talent acquisition, development, and retention strategies within tax departments, and what skills will be essential for future tax professionals.

- Data Security: Gain insights into the challenges and solutions related to data security in an AI-driven tax environment, ensuring compliance and protecting sensitive information.

- Risks and Controls: Learn about the potential risks associated with AI in tax and the necessary controls to mitigate these risks, ensuring robust and reliable tax processes.

The Evolution of Modernized Tax Authorities: Updates, Outlook, Impact to Your Strategy [General Tax Tech Track]

12/17/24 - 3:00-4:30 pm ET

Join us for an insightful session that provides an update on the Forum on Tax Administration’s latest discussion report and action plan. This session will outline the vision for the digital transformation of tax administration, as envisioned by the OECD, and how it’s influencing global mandates and trends, and provide valuable perspectives on how modernized tax authorities are evolving and what this means for both tax professionals and taxpayers.

Future of Tax Research with AI: Key Considerations and Outlook for 2025 [AI Track]

12/18/24 - 12:00-1:30 pm ET

Join us for an in-depth session on the future of tax research, focusing on the role of generative AI in navigating tax laws and regulations. We’ll delve into the critical points and potential pitfalls to consider when integrating generative AI tools into your tax department. Learn about the latest advancements and practical applications of AI in researching tax laws, compliance requirements, and regulatory changes. This session will also provide a forward-looking perspective on 2025 outlook, highlighting emerging trends and innovations that could revolutionize tax research practices. Prepare to navigate the evolving landscape of tax law and regulation research with confidence and stay ahead of technological advancements shaping the future of the field.

Synergy in Tax: Uniting People, Process & Technology [General Tax Tech Track]

12/18/24 - 3:00-4:30 pm ET

Join us for an engaging session where in-house tax technology leaders share their insights on the critical role of people in their tax technology journeys. This session will delve into the dynamic interplay between people, process, and technology within a tax technology strategy and operating model. Gain insights into the latest trends and catalysts that are shaping the approach to advancing tax technology and operations, where recent efforts have been focused to unlock new capabilities for the tax function, and hear stories of impact and inspiration.

Transforming Tax: AI-Driven Innovations with Microsoft Cloud and Copilot [AI Track]

12/19/24 - 12:00-1:30 pm ET

Join us for an insightful session where we delve into Microsoft’s comprehensive strategy for integrating artificial intelligence across its platform and products. Discover how AI is revolutionizing various aspects of technology and enhancing user experiences. Additionally, the session will show practical applications of AI in tax. This session promises to provide valuable insights and real-world examples of AI in action.

Emerging Tax Technology: Perspectives from Incubation Leaders [General Tax Tech Track]

12/19/24 - 3:00-4:30 pm ET

Join us for an enlightening session where leading tech vendors and incubation leaders share their perspectives on the future of tax technology. This session will provide critical insights into the next wave of tech-enabled capabilities poised to revolutionize tax departments.

CPE/CLE Information

CPE Credit Information: Tax Executives Institute Education Foundation is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of “group live based” continuing professional education on the National Registry of CPE Sponsors.

Date: December 16-19, 2024 (2 sessions per day)

Delivery Method: Group Internet Based

Program Level: Basic

Prerequisites: None

Field of Study: Taxes

Advanced Preparation: No advanced preparation required

CPE Credits possible: Approximately 12.0 CPE credits based on a 50-minute hour.

Learning objectives:

Sponsoring Organization: Tax Executives Institute, Inc. TEI Education Fund, 1200 G. Street, NW, Suite 300, Washington, DC 20005

State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. To submit a complaint about a specific program, speaker or content, please email meetings@tei.org. Complaints regarding sponsors may be addressed to National Registry of CPE Sponsors, 150 Fourth Avenue North, Ste. 700, Nashville, TN 37219-2417. Website: www.nasbaregistry.org

For more information regarding administrative policies such as complaint or refund, or for questions related to this or other TEI events please contact TEI, directly, at 202.638.5601 or meetings@tei.org.

Registration Information

To register, click on the blue "Register" button at the top of the meeting page to register (when available).

Full Series - 8 Sessions

TEI Member price - $550

Non-Member price - $700

** TEAM Discount - TEI is offering a 20% off "team discount" on the second and subsequent person from your organization registering for the Full Series (no discount on single sessions or track sales). The first registrant from your organization would pay full price and then the second and subsequent registrants should put in discount code "24TTWS-TEAM" during the online registration process.

Track Registration - 4 Sessions [AI or General Tax Tech Track]

TEI Member price - $275

Non-member price - $350

Single Session - Per Session

TEI Member price - $75

Non-Member price - $100

Group Registration (or registering someone other than yourself) - To register a group or to register someone other than yourself, please complete and send back a registration form for each registrant.

Member rates are available to TEI members only. Member benefits, such as member pricing, are not transferrable to non-members.

Need to renew? Visit www.tei.org, login, and select "Membership Expired -- Rejoin Today" above your profile.

Not a member? Learn more about the benefits of membership and join today to save on this event and gain access to all TEI member benefits and TEI educational offerings.

REMINDER: TEI Events are open to members of TEI and other in-house tax professionals only. Individuals engaged in private law, accounting, or other consulting practice are eligible to attend. Government employees are also ineligible to attend.

Cancellation and Substitution Policy

Cancellation - All cancellations must be received in writing by December 6, 2024 to meetings@tei.org.

Cancellations will be subject to a $50 cancellation fee. There is no partial refunds if you can only attend some of the sessions.

Substitutions may be made prior to the start of the series, however there is no partial registrations or sharing of registration for CPE purposes. Substitutions requests should be emailed to meetings@tei.org and are subject to a $25 fee.

.png)

.png)