Tax Executives Institute, Inc. (TEI or the Institute) was founded by a group of 15 tax professionals who foresaw the need for an organization that would transcend traditional professional organizations in scope and function and that would provide a forum for exchanging information among the members of a new and growing profession — in-house tax executives.

The Institute’s operations are governed by its By-Laws, which are periodically amended to meet changing conditions. In addition, the Board has adopted Chapter Regulations covering the operation of chapters. This Manual of Organization & Operation (the MOP) is a compilation of guidelines and procedures relating to finances, membership, legislative and technical activities, and other activities adopted by TEI’s Board of Directors. It also includes materials relating to the purposes, organization, and operation of TEI. It is intended primarily to benefit the Institute, regional, and chapter officers, directors, committees, and staff.

For additional assistance or questions, please visit our Support & FAQ page.

Table of Contents

- Institute Organization & Governance

- Membership

- Institute Standing Committees

- Institute Policy on Legislative and Technical Activities

- Institute Nominating Committee Procedures

- Leadership Development Guidelines

- Institute Awards

- Institute Conferences & Meetings

- Institute Financial Matters

- Institute Investment Policy

- TEI Conflict of Interest Policy

- TEI Whistleblower Policy

- TEI Joint Venture Policy

- Toolkit: Criteria & Process for Establishing a Chapter Scholarship Program

- Toolkit: Chapter Resolution Concerning Alcohol

- Toolkit: Audit Committee Procedures

- Toolkit: Required Notice on Chapter Billings

- Toolkit: Sample Chapter Financial Aid Policy

- Toolkit: Chapter Officer Checklist

- Toolkit: Procedures for Annual Chapter Meetings

- Toolkit: Meeting Planning Guidelines for Regions & Chapters

- TEI Exemption Letters

- Restated Articles of Incorporation

Governing Documents

Statement of Mission, Principle and Purpose

Statement of Mission, Principle and Purpose

Board Approved June 22, 2017

Tax Executives Institute, Inc. is the preeminent global association of in-house tax professionals. TEI’s members are business executives responsible for the tax affairs of their employers in an executive, administrative, or managerial capacity. TEI serves its members and advances the profession by education, networking, and advocacy throughout the world.

Mission

The mission of Tax Executives Institute is to enhance and improve the global tax system and to serve its members, their employers, and society generally by facilitating interaction among, and the training of, members and their staffs, by effectively advocating its members’ views, and by promoting competence and professionalism in both the private and government sectors.

Principle

Tax Executives Institute is dedicated to the development of sound tax policy, compliance with and uniform enforcement of tax laws, and minimization of administration and compliance costs to the benefit of both government and taxpayers. These goals can be attained only through the members’ voluntary actions and their adherence to the highest standards of professional competence and integrity.

Purpose

· To create a global community of tax professionals and support their professional development and career progression, and thus the business entities for whom they work.

· To facilitate the global association of professionals whose work is principally concerned with administering the tax affairs of business entities and to enhance the role of tax executives in the management of those entities.

· To promote an awareness among business entities and government of the significance of both taxes and tax administration as a cost of business and a factor in global competitiveness, and of the importance of sound business tax management practices.

· To promote and support the improvement of the tax laws, and of their administration, at all levels of government throughout the world.

· To cooperate and exchange ideas with government tax officials for the purpose of identifying and resolving issues and problems in tax administration.

· To promote the interchange of ideas and mutual assistance among the members, and between the members and government tax officials.

· To promote high standards of competence, professionalism, and performance in business tax management and government tax administration.

· To obtain and disseminate information on the subject of taxation for the benefit of the members, their employers, and other interested parties, through educational programs, publications, or otherwise.

· To promote an inclusive culture that attracts, engages, and retains diverse tax professionals.

Standards of Conduct

Standards of Conduct

Board Approved June 22, 2017

Because the Mission, Principle, and Purposes of Tax Executives Institute can be achieved only by the members’ observance of the highest ethical standards, the Institute has adopted the following standards of professional conduct:

· The member accepts taxes as a cost of civilization and accepts the laws imposing taxes as the mechanism for distributing that cost among businesses, individuals, and other entities. The member will comply with those laws, whether or not agreeing with them.

· The member recognizes an obligation to minimize company tax liability, within the bounds of the law and to the extent consistent with policies or objectives of the company.

· The member recognizes an obligation to make an affirmative contribution to the sound administration of tax laws and to the development and adoption of sound tax legislation, by cooperation and consultation with the persons charged with those functions, having due regard for the interest of the company, its employees, and society as a whole.

· The member accepts each government representative as a responsible person who is a professional required to fulfill the obligation to collect tax in accordance with the law. The member will deal with the representatives on that basis, and will take occasion with others to uphold this view of government representatives. In case of any deviation by a government representative from that standard, the member will present the pertinent facts to the authorities authorized to take action with respect to the deviation.

· The member will present the facts pertinent to the resolution of questions at issue to representatives of the government imposing the tax.

· The member will employ assistants and outside representatives upon the basis of their technical competence, always having due regard for the highest standards of professional ethics.

· The member will create an inclusive and collaborative culture that encourages individuals with diverse backgrounds and talents to lead, contribute, and progress.

· The member will at all times recognize a duty of professionalism and will not use TEI membership to solicit business or sell products to other members.

By-Laws

Article I. Membership

Section 1(i). Full membership shall be open to persons not engaged in public tax practice who are employed by corporations and other businesses and are charged with the responsibility for directly or indirectly administering the taxation of their organization.

Section 1(ii). Student membership shall be open to persons who are enrolled full-time in either undergraduate or graduate programs that provide an appropriate foundation for a career in taxation. Student members shall not be employed full-time in a position consisting principally of administering taxes. Student membership shall continue until such time as the student member is no longer enrolled in a qualifying educational program and shall not exceed five (5) years. A student member shall pay reduced dues, shall have no vote in Institute-level balloting, and shall not be eligible to hold office in a chapter or in the Institute.

Section 2. As provided in Article VI, Section 3 of these By-Laws, the Board of Directors shall designate a Membership Committee that shall review and act upon applications for membership. Election to membership shall be determined by the Membership Committee, which shall act in accordance with these By-Laws and the guidelines established by the Board. Should the Membership Committee refuse an application for membership, the applicant may request the Board to review the Membership Committee’s decision, and the Board may, in its discretion, elect such applicant to membership.

Section 3. Any member or former member who shall no longer be eligible for membership under the provisions of Article I, Section 1 of the By-Laws shall be eligible for emeritus membership, provided that any subsequent activities are not inconsistent with the Principle and Purposes of the Institute, that such emeritus membership will be confined to members or former members who have retired from qualifying employment and are not otherwise gainfully employed and, further provided, that such emeritus membership shall cease if such retirement ends and the individual becomes gainfully employed or self-employed. Election to emeritus membership shall rest in the discretion of the Membership Committee. Should the Membership Committee refuse an application for emeritus membership, the applicant may request the Board of Directors to review the Membership Committee’s decision, and the Board may, in its discretion, elect such applicant to emeritus membership.

Section 4. Any person who shall have rendered conspicuous service in the field of tax administration and/or the activities of this Institute shall be eligible for honorary membership. Election to honorary membership shall rest exclusively in the discretion of the Board of Directors. Honorary membership shall continue in effect until terminated by the Board of Directors. An honorary member shall pay no dues, shall have no vote, and shall not be eligible to hold office in the Institute except as otherwise determined by the Board of Directors.

Section 5. The Board of Directors may authorize such membership certificates, scrolls, or certificates of honor, etc., as it may deem proper. The Board may, in its discretion and for any reason, require the return of any such membership certificates, scrolls, or certificates of honor, etc., to the Institute.

Section 6. Resignation from membership shall be effective when received by the Institute.

Section 7. Involuntary termination of membership for a member of any category may be effectuated only if the Board of Directors of the Institute shall find, as provided herein, that the member has committed an act prejudicial to the Institute or to its Principle and Purposes, or otherwise no longer meets the eligibility requirements prescribed in Section 1, 3, or 4 of this Article I.

Proceedings to terminate the membership of any member shall be commenced by a resolution of the Board adopted by two-thirds of those present at the meeting at which such resolution shall be considered and voted upon. Such resolution shall specify in detail the act or acts alleged as the basis for such involuntary termination of membership. The person against whom such proceedings are brought shall be promptly furnished with a copy of such resolution and shall be afforded an opportunity for a hearing before the Board with respect to the truth or falsity of the charges. Such hearing shall take place not less than sixty (60) days after such notification. After the conclusion of the hearing the Board shall make its decision in the matter, which shall be final; provided, however, that a decision to terminate the membership shall not be effective unless approved by at least three-fourths of the directors present at the meeting at which such decision is considered and voted upon. No person against whom proceedings for termination of membership shall be brought shall be entitled to vote on any matter in connection therewith.

Article II. Directors and Officers

Section 1. Except as otherwise required by law or provided by these By-Laws, the entire control of the Institute and of its affairs and property shall be vested in the Board of Directors. The Board shall consist of the following:

· All Officers of the Institute;

· Until otherwise changed by a majority action of the Board, one director from each chapter of the Institute; and

· The qualifying Past Presidents of the Institute who shall continue their membership and consent to serve as directors, provided that the size of the Board may not be reduced at any time if the effect of such reduction would be to remove an incumbent director.

Except as provided in Section 4 (in respect of Chapter Representatives) and Section 8 (in respect of vacancies) of this Article, directors shall be elected by the full members of the Institute at the Annual Meeting of Members and each director shall be elected to serve for such director’s respective term of office or until a successor shall be elected and shall qualify. The President of the Institute shall be the chair of the Board of Directors.

Section 2. The officers of the Institute shall be a President, a Senior Vice President, one or more Vice Presidents, and at the discretion of the Board of Directors, a Secretary, and a Treasurer, all of whom shall be full members of the Institute, who shall be elected in accordance with the procedure set forth in Article V, Section 5 of these By-Laws. Said officers shall hold office for one year or until their successors are elected and assume office. Any full member may hold two of the aforesaid offices and may also hold office as a director or as an officer or director of any chapter.

Section 3. The officers shall perform the duties which are usually performed by such officers, and such duties as may be assigned to them from time to time by the Board of Directors. The President, or in the President’s absence the Senior Vice President, shall preside at all meetings of members of the Institute and both shall be ex-officio members, without vote, of all committees of the Institute, except the Nominating Committee. Further, in the event of the inability or incapacity of the President to carry out the duties of the office, such duties shall be performed by the Senior Vice President.

Section 4. Each of the Chapters shall have the right, once every two years, to elect a director who shall be a full member of the Institute to a two-year term (Chapter Representative). The terms of office with respect to directors from the chapters shall be staggered so that the number of directors elected from the chapters each year shall be one-half of the number of chapters of the Institute. The manner of the election shall be prescribed in the Chapter Regulations.

To the maximum extent possible, the tenure of a Chapter Representative shall be limited to two consecutive two-year terms. A Chapter Representative may serve a third consecutive term only if the chapter explains in a written report submitted to the Executive Committee prior to the commencement of such third consecutive term why it is in the best interests of the Institute to extend service in this way. Under a rebuttable presumption, a Chapter Representative may not serve more than three consecutive terms. A chapter can rebut the presumption and have a Chapter Representative serve more than three consecutive terms by submitting a written report to the Executive Committee explaining: i) the steps the chapter has taken to develop new leadership and identify a replacement, and ii) why it is necessary for the incumbent Chapter Representative to serve another term. Such process must be followed each succeeding two-year term that a chapter wishes to elect the same chapter representative.

Section 5. Past Presidents of the Institute who complete their service as President on or before the 2018 Annual Meeting of the Members, shall be nominated to serve on the Board each year as long as they continue their full membership and consent to serve as directors. Past Presidents of the Institute who complete their service as President after the 2018 Annual Meeting of the Members, shall be nominated to serve on the Board for up to six consecutive one-year terms following their service as President as long as they continue their full membership and consent to serve. Nothing in this section shall limit the eligibility of a Past President to serve on the Board as a Chapter Representative or an Officer.

Section 6. The Board of Directors shall hold at least two scheduled meetings annually. The first scheduled meeting shall be held immediately following the adjournment of the Annual Meeting of Members of the Institute. Notice of such meeting shall not be required. The second scheduled meeting shall be held at the call of the chair within 120 days subsequent to January 1 of each year. The Board of Directors may hold meetings other than the two regularly scheduled meetings at such places and at such times as it shall determine. The chair shall preside at all meetings. Meetings of the Board may be called at any time by the chair, or by any 10 members of the Board upon at least one week’s notice to each director. One third of the members of the Board of Directors shall constitute a quorum for all purposes.

Any one or more members of the Board may participate in a meeting of such Board by means of a conference telephone or similar communications equipment allowing all persons participating in the meeting to hear each other at the same time. Participation by such means shall constitute presence in person at a meeting.

Section 7. The resignation of any officer or director shall be effective when accepted by the Board of Directors.

Section 8. If, by reason of resignation, death, ineligibility, or otherwise, any vacancy shall occur in any office, or in the Board of Directors with respect to a director who was automatically nominated for Board membership because of being elected an officer of the Institute, the Board of Directors shall elect a member of the Institute who satisfies established qualification requirements to fill such vacancy provided, however, that should a vacancy occur in the office of President, the Senior Vice President shall perform all of the duties of President until a successor has been elected by the Board of Directors.

If, with respect to a director from any chapter, a vacancy occurs or any new directorship is created by any increase in the authorized number of directors resulting from the institution of a new chapter, the board of directors of said chapter may elect a member from its chapter who satisfies established qualification requirements to fill such vacancy or to fill the newly created directorship.

Officers and directors elected as herein provided shall hold office only until the next Annual Meeting of Members, at which a director or directors who shall serve for the remainder of any unexpired term or terms shall be elected.

Section 9. All directors and officers nominated and elected as provided herein shall assume office at the conclusion of the Annual Meeting of Members, except that the officers and directors elected by the Board of Directors as provided in Section 8 of this Article II shall assume office immediately following their election by the Board of Directors.

Section 10. The Board of Directors may appoint an Executive Director, one or more assistant secretaries, and such other employees, agents, and professional or technical counsel, as it may from time to time determine are required, none of whom need be members of the Institute, and may fix and pay the compensation thereof and reimburse them for such expenses as it may deem proper. The Executive Director shall be an ex-officio member, without vote, of the Board of Directors (except that the Executive Director shall not be deemed a director in ascertaining the number of directors under Article II, Section 1 or Article III, Section 4 of these By-Laws) and of all committees of the Institute except the Nominating Committee.

Section 11. The Board of Directors, at its first scheduled meeting, shall appoint an independent certified public accountant who shall examine the records and financial statements of the Institute for the current fiscal year and who shall submit a duly verified report thereon to the Board of Directors.

Section 12. No elected officer or director, including chapter officers and directors, shall receive directly or indirectly, any salary, compensation or emolument from the Institute or chapter, but reimbursement may be made for actual expenses when authorized by the Board of Directors.

Article III. Meetings

Section 1. The Annual Meeting of Members of the Institute shall be called within a period of forty-five (45) days subsequent to July 1 of each year, for the purpose of electing directors, as provided in Article II, Section 1 and for the transaction of such other business as may be presented thereto. All categories of members may attend the meeting, but only full members shall be entitled to participate in Institute-level balloting. A meeting so called may be adjourned on account of a lack of a quorum or for such other reasons as the President may for good cause determine, provided the meeting is convened as soon as practicable thereafter.

At the Annual Meeting of Members, the President shall make a report of the activities of the Institute since the preceding Annual Meeting of Members, including therein a summary of the total membership of the Institute and the Institute’s financial results. The the report of the independent certified public accountant referred to in Article II, Section 10 shall be filed with the records of the Institute. Copies of the report shall be furnished to the Board of Directors at its first scheduled meeting (including any adjourned date thereof) following the date that the report is finalized, and a copy of the report shall be filed with the minutes of such meeting.

Section 2. The Secretary shall call meetings of the Institute at such time and place as directed by the President or a majority of the Board of Directors. Such meetings may be held outside the State of New York.

Section 3. Notice of all meetings of the Institute shall be mailed to full members at least two weeks before the date of such meeting and shall state the time, place, and purposes thereof.

Section 4. Ten (10) percent of the full members of the Institute, whether present in person or represented by proxy, shall constitute a quorum for all purposes.

Section 5. All proxies must be executed in writing, provided by electronic mail or accomplished by other means that are valid under section 609(b) of the New York Not-for-Profit Corporation law, as amended. Proxies may be general or specific, and may be revoked at any time, but in any event shall not be valid after the expiration of six months from date of execution. Revocation of proxies shall be made in writing mailed to or filed with the Secretary or by electronic mail with the Secretary.

Section 6. Notice of any meeting prescribed by these By-Laws may be waived in writing by a full member or director as the case may be.

Section 7. The order of business at any meeting, as set forth in the meeting agenda, may be changed by a majority of the full members present in person or represented by proxy. A motion to change the order of business shall not be debatable.

Article IV. Dues and Finances

Section 1. The amount of the annual dues of all member categories shall be established by the Board of Directors annually in advance, a portion thereof deemed to cover the cost of publication of Tax Executive and other publications of the Institute. The Institute shall remit annually to each chapter a pro-rata amount established by the Board of Directors from the dues paid by each full member of each chapter (i.e., excluding student members and emeritus members). The amount so established shall be uniform throughout the Institute. The portion of the annual dues remitted by the Institute to the chapter is intended to defray the cost of chapter operations for postage, mailings, expenses of guest speakers and prospective members, and other normal administrative expenses, and the chapter may not collect additional dues from members. The chapter may, however, assess members for meals, beverages, and other costs of chapter functions.

The Institute’s fiscal year shall run from July 1 to June 30. Dues payments shall cover this period, and the Treasurer of the Institute shall have the authority to prorate the dues of new members so that all members can be billed on the same date. Dues shall be billed at least sixty (60) days in advance of the beginning of the year, and thirty (30) days before the beginning of the year, an additional notice shall be mailed to unpaid members. At the beginning of the fiscal year, a notice of delinquency shall be mailed to unpaid members apprising them of their delinquency and of their ineligibility to receive any benefits of membership. The Board of Directors shall have authority to impose a late charge in respect of any member paying after the beginning of the Institute’s fiscal year. If the period of delinquency continues for an additional thirty (30) days, the membership shall automatically terminate; the Board of Directors, however, may provide for subsequent reinstatement.

Section 2. The Board of Directors shall establish the policy for the deposit and investment of Institute funds, including chapter and regional funds. Such funds shall be disbursed upon the order or orders of such persons as may be prescribed by the Board of Directors.

Section 3. The fiscal year of the Institute shall end June 30.

Article V. Nominations

Section 1. The Board of Directors, at its first scheduled meeting, shall appoint a Nominating Committee, the chair of which shall be the immediate Past President. The members of the Nominating Committee shall be the President, Senior Vice President, and the immediate Past President, and one member appointed from each of the regions represented by a Vice President. There shall also be appointed from each region, an alternate to serve as a member of the Nominating Committee in the event the member appointed from such region is unable to serve. All members and alternates of the Nominating Committee shall be full members of the Institute. The member and alternate from each region shall be appointed by the Board upon the recommendation of a caucus of the Board members representing the chapters within each respective region. The caucus shall be chaired by the Regional Vice President, or, in the absence of the Regional Vice President, by a Board member from the region, as selected by the President. A current Board member may also serve on the Nominating Committee so long as the Board member is not running for Institute officer (subject to the exception for qualifying representatives in circumstances described below in section 2(i)), is not a member of the Executive Committee (subject to the exception for the President and Senior Vice President who will also serve on the Executive Committee), or is not a Past President in the second year after serving as President. No member who served on the last preceding Nominating Committee shall be eligible for appointment to the Nominating Committee.

Section 2(i). The Nominating Committee shall make nominations for officers, except that the Senior Vice President shall automatically succeed to the office of President at the next Annual Meeting of Members by operation of these By-Laws. No member of the Nominating Committee shall be nominated for office by the committee unless the chair of the Nominating Committee in his or her sole discretion, not to be unreasonably exercised, authorizes an exception. The chair is authorized to grant exceptions for representatives from the Institute’s non-North American chapters and regions provided no other member from the affected chapter or region is available to serve and replacement members of the Nominating Committee (described below in Article V, section 2(ii)). If such an exception is granted, the member serving the dual role as a member of the Nominating Committee and candidate for office shall leave the room during discussion of and voting on his or her candidacy, and reenter once voting for that position has concluded. Under no circumstances, however, shall a member serve on the Nominating Committee if that member is also a candidate for Secretary.

Section 2 (ii). Nominations for officers shall be decided upon by those members appointed from each of the regions (or their alternates) who are physically present at the Nominating Committee meeting (collectively, the Voting Members of the Nominating Committee). In recognition of the fact that from time to time a region’s representative to the nominating committee may be unable to attend the meeting due to a force majeure or other extenuating circumstances, the Chair of the Nominating Committee shall have sole discretion, not to be unreasonably exercised, to grant an exception to the physical presence requirement by allowing such representative to participate by means of a conference telephone or similar communications equipment that allows all persons participating in the meeting to hear each other at the same time or by allowing such representative to name a replacement to the committee from the representative’s region, including a member of the Board. Each of the Voting Members of the Nominating Committee shall have an equal vote in determining nominees for officers. The President, Senior Vice President, and chair of the Nominating Committee shall not be entitled to a vote, except in the event of a tie in which case the chair, or, if the chair is absent, the President, shall be entitled to cast a vote.

Section 2 (iii). A report reflecting the results of the vote of the Voting Members of the Nominating Committee signed by a majority of such members shall be filed with the Secretary not later than January 31. The report shall be distributed to the membership no later than March 1, either by publication in the Institute’s magazine, by mail, or by posting to the Institute’s website. Such report shall include a statement containing the name of each retiring officer and the name or names of persons nominated as the successor.

Section 3. Nominations may also be made by twenty-five or more members of the Institute. Such nominations shall be in writing, signed by the nominating members, and filed with the Secretary not later than March 31. A report of such nominations shall be distributed to the membership no later than May 1, either by publication in the Institute’s magazine or by mail, and such report shall be in as great detail as specified in Section 2 of this Article V.

Section 4. Only full members of the Institute shall be eligible for nomination.

Section 5. Only nominations made as hereinbefore provided in this Article V shall be in order.

Section 6. If the slate of officer nominees selected by the Nominating Committee as provided in Section 2 of this Article is unopposed (with no other nominations having been made under Section 3 of this Article), the unopposed officer nominees shall be deemed elected by operation of these By-Laws.

If more than one individual is nominated for a position(s) (either by the Nominating Committee or by a petition filed in accordance with Section 3 of this Article V), the names of those nominees shall be placed on a ballot and mailed to the members of the Institute. To be counted, the mail ballots must be returned to the Secretary no later than June 30 each year. The unopposed nominees selected by the Nominating Committee shall be deemed elected by operation of these By-Laws.

Article VI. Committees

Section 1. The Board of Directors at its first scheduled meeting shall appoint an Executive Committee from among the members of the Board.

The Executive Committee shall consist of 11 members, 4 of whom shall be the President, the Senior Vice President, the Secretary, and the Treasurer. The President shall serve as chair and the Senior Vice President as vice chair of the committee.

If, for any reason, one or more of the above officers are unable or unwilling to serve, their places shall be filled from among other members of the Board, by election by the Board. The Executive Committee shall have and exercise such powers of the Board of Directors in the management and business affairs of the Institute as may be delegated in writing by or by minutes of the Board, and not otherwise inconsistent with any other provision of these By-Laws. The Executive Committee shall keep minutes of its meetings which shall be submitted for ratification at the next succeeding meeting of the Board of Directors. The Executive Committee shall hold regular meetings monthly or as it may otherwise determine, at such places and at such times and upon such notice as it may in its discretion determine.

Section 2. Meetings of the Executive Committee may be called at any time by the chair of the committee or by any two of its members upon at least two days’ notice.

Six members of the Executive Committee, present either in person or by telephone, shall constitute a quorum for all purposes. Except where otherwise provided by the Board of Directors, the Executive Committee may take any action by a majority vote.

Section 3. The Board of Directors at its first meeting after every Annual Meeting shall, except as otherwise provided in these By-Laws, designate a Membership Committee and such other standing committees as deemed appropriate, and the duties of each such committee. The Membership Committee shall, in accordance with Article I, Sections 2 and 3 of these By-Laws and the guidelines established by the Board, review and act upon applications for all categories of membership. In its discretion, the Board may establish the number of members to serve on each standing committee.

Section 4. Except as otherwise provided in these By-Laws, the President shall designate the personnel of each committee and the chair thereof. Only full members of the Institute shall be eligible to serve on Institute standing committees.

Article VII. Seal

Section 1. The seal of the Institute shall consist of two concentric circles having between the words, “TAX EXECUTIVES INSTITUTE, INC.”, and in the center the words “CORPORATE SEAL-1944-NEW YORK.”

Article VIII. Chapters

Section 1. The Board of Directors may authorize local chapters of the Institute in such manner and subject to such regulations as it may determine. In exercising this authority, the Board may approve the Institute’s establishment of another organization, whether organized under the laws of the United States, Canada, or another country, and provide such organization with representation in the Institute’s governance.

Section 2. Members not located within the area of any local chapter shall be designated as members-at-large only until such time as a local chapter may be organized within the area. The definition of area is at the discretion of the Board of Directors.

Article IX. Rules of Procedure

Section 1. The rules of procedure at meetings of the members of the Institute shall be according to Robert’s Rules of Order, so far as applicable and when not inconsistent with these By-Laws. The rules of procedure at any meeting may be changed by a majority of the members present in person or represented by proxy.

Article X. Amendments

Section 1. Amendments to the By-Laws may be proposed by the Board of Directors or by not less than five percent of the entire number of full members of the Institute. Amendments so proposed shall become effective if (1) a majority of the full members present in person or represented by proxy at any meeting of the members of the Institute shall vote in favor of such amendments to the By-Laws, provided notice of the meeting with provision for voting by proxy has been mailed to the full members of the Institute at least 30 days prior to the date of such meeting; or (2) a majority of the entire number of full members of the Institute shall vote by mail ballot in favor of such amendments to the By-Laws.

Section 1: Institute Organization & Operations

Organization & Governance

Introduction

Tax Executives Institute, Inc. (TEI or the Institute) was founded by a group of 15 tax professionals who foresaw the need for an organization that would transcend traditional professional organizations in scope and function and that would provide a forum for exchanging information among the members of a new and growing profession — in-house tax executives.

The individuals who signed the Certificate of Incorporation were Paul W. Smith, Harry J. Wright, Virgil Smith, Henry J. Williams, Carl H. Arnold, James A. Greig, Paul E. Aberli, Robert Young, and Charles J. Flynn. The first meeting of the Institute was held in New York City in June 1944. On October 24 of the same year, a Certificate of Incorporation was approved by the State of New York. The continual growth of TEI is evidence that the organization fills a real need among in-house tax executives and of the increasing professional status of tax executives themselves.

The Institute’s operations are governed by its By-Laws, which are periodically amended to meet changing conditions. In addition, the Board has adopted Chapter Regulations covering the operation of chapters. The By-Laws and Chapter Regulations are reprinted in this Manual, as are TEI’s Restated Articles of Incorporation.

This Manual is a compilation of guidelines and procedures relating to finances, membership, legislative and technical activities, and other activities adopted by TEI’s Board of Directors. It also includes materials relating to the purposes, organization, and operation of TEI. It is intended primarily to benefit the Institute, regional, and chapter officers, directors, committees, and staff.

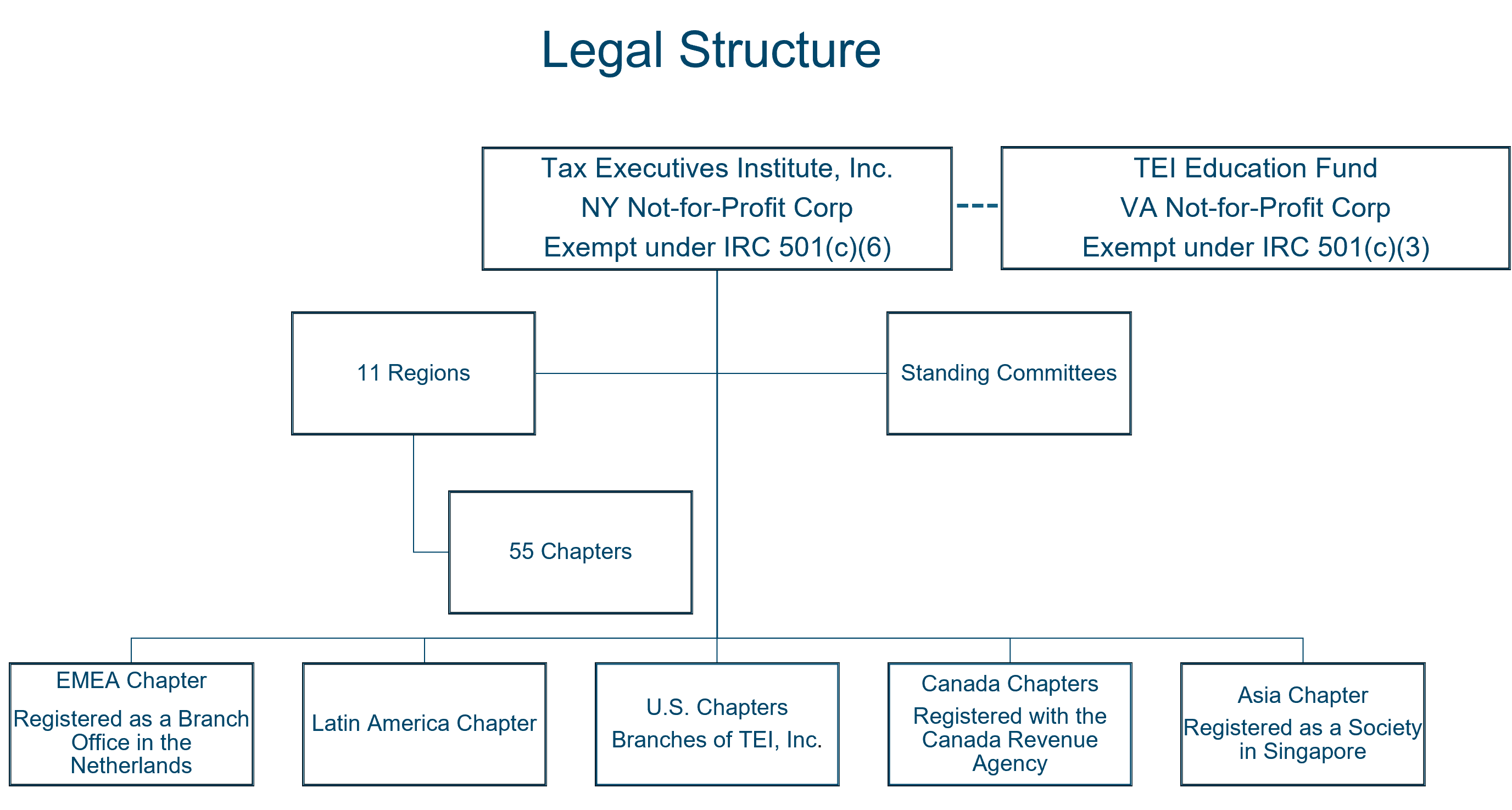

Corporate Structure

Tax Executives Institute, Inc.

Tax Executives Institute, Inc. is a not-for-profit corporation formed in 1944 under the laws of New York and is exempt from taxation under section 501(c)(6) of the Internal Revenue Code. The Institute’s employer identification number is 52-0239291. See TEI Exemption Letters for a copy of TEI’s exemption letter from the Internal Revenue Service.

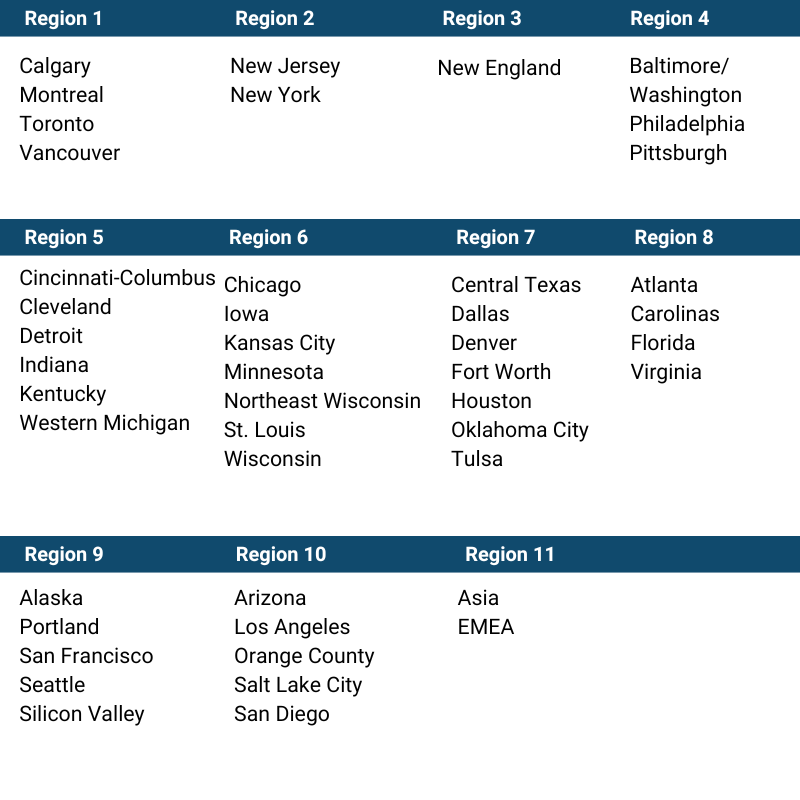

Tax Executives Institute has 55 chapters organized into 11 regions throughout the United States, Canada, Latin America, Europe, and Asia. The EMEA chapter is registered as a branch office in the Netherlands, the Latin America chapter is registered to do business in Brazil, the Canadian chapters are registered with the Canada Revenue Agency, and the Asia chapter is registered as a society in Singapore.

Although each chapter has its own officers and directors, and maintains its own bank account, each chapter is a unit of the whole organization. Therefore, TEI’s By-Laws, together with Chapter Regulations, govern each chapter and region. Chapter and regional financials are excluded from TEI’s internally prepared and audited financial statements; however, they are included in TEI’s annual Form 990 return.

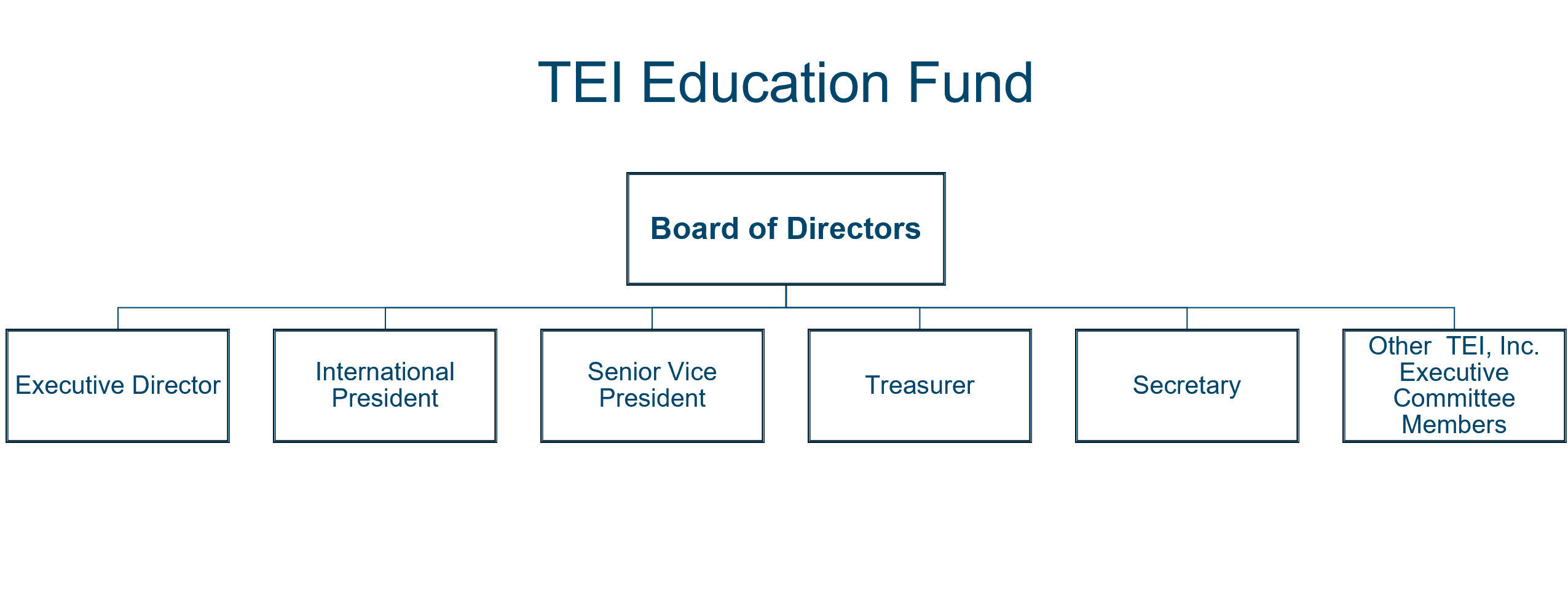

TEI Education Fund

TEI Education Fund (Fund) is organized as a non-stock corporation under Virginia state law and is exempt from taxation under section 501(c)(3) of the Internal Revenue Code. The Fund’s employer identification number is 54-1402262. See TEI Exemption Letters for a copy of the Fund’s exemption letter from the Internal Revenue Service.

The Fund’s activities include sponsoring the week-long tax courses —Federal Tax Course-Level 1, Federal Tax Course-Level 2, and the U.S. International Tax Course. Before the establishment of the Fund, these tax programs were sponsored by TEI. The Fund also cosponsors the Institute’s conferences and seminars.

The Fund has no paid staff; therefore, the Fund contracts with the Institute to administer the tax courses (and for other services). In addition, as a section 501(c)(3) organization, the Fund will consider requests for reimbursement for government and academic speakers at Fund and TEI-sponsored education programs (including those at the chapter and regional level; see the Government Travel Expenses section for more information).

Under current procedures of the Fund, reimbursement requests are granted for government representatives and speakers affiliated with colleges, universities, or other section 501(c)(3) organizations. The Fund will also consider requests for reimbursement of expenses incurred by TEI members or staff to participate in educational programs sponsored by the Internal Revenue Service, other government agencies, colleges or universities, or other section 501(c)(3) organizations. Occasionally, the Fund will be asked to approve grants for special educational programs or other projects; these requests will be considered on a case-by-case basis.

Throughout this Manual, references are made to Institute courses and other programs. For the above-mentioned courses are sponsored by the Fund (and merely administered by the Institute), those references should be so construed.

The Fund’s members consist of the members of the Executive Committee of TEI, and the Fund’s Board of Directors comprises all of the Fund’s members and the Institute’s Executive Director. The Institute’s senior officers (President, Senior Vice President, Secretary, and Treasurer) hold the same offices with the Fund (with the Senior Vice President of the Institute serving as the Fund’s Vice President), and the Institute’s Executive Director serves in the same capacity with the Fund.

Board of Directors

Function

The Institute’s By-Laws provide that the control of the Institute and its affairs and property is vested in the Board of Directors. The Board shall have such number of directors as the Board shall set from time to time, but the size of the Board may not be reduced at any time if this reduction would remove an incumbent director. Absent Board action, the By-Laws state that the number of directors constituting the Board shall equal (1) the number of chapters of the Institute, (2) the number of qualifying Past Presidents of the Institute who continue their membership and consent to serve as directors, and (3) the number of elected officers of the Institute. (The number of directors may be fewer if a chapter representative also serves as an Institute officer.)

Composition

Each chapter has the right, once every two years, to elect a chapter representative who serves as a director on the Board for a two-year term. Chapter representatives’ office terms are staggered so the number of directors elected from the chapters each year is one-half of chapters of the Institute.

Chapters have final authority to select their representatives to the Board of Directors. Nevertheless, to the maximum extent possible, the tenure of a chapter representative to the Board should be limited to two consecutive, two-year terms. A chapter representative may serve a third consecutive term only if the chapter submits a written report submitted to the Executive Committee before the commencement of such third consecutive term. This report must outline why it is in the best interests of the chapter and the Institute to extend service in this way and explain the steps the chapter took to develop new leadership and identify a replacement, and the reasons a replacement was not available (i.e., why it is necessary for the incumbent chapter representative to serve another term). This process must be followed each succeeding two-year term if a chapter wishes to elect the same chapter representative.

Each regional also appoints a Regional Vice President to serve as an officer on the Board of Directors. Regional Vice Presidents are appointed by the Nominating Committee and elected by the full membership on the annual proxy, and generally serve two-year terms.

The other Institute officers (Secretary, Treasurer, Senior Vice President, and President) are appointed by the Nominating Committee and elected by the full membership annually. These officers and qualifying Past Presidents of the Institute serve one-year terms on the Board. The Institute’s President is the chair of the Board of Directors.

Meetings

The Board of Directors must hold at least two meetings annually and, in recent years, has held three in-person meetings—one in August following the Annual Meeting of Members, the second during the Annual Conference, and the third during the Midyear Conference. The Board may also meet virtually and, in recent years, has done so several times a year.

A meeting of the Board of Directors must have one-third of its members present (including by phone) which constitutes a quorum to transact business. Because service as a director involves the discharge of a nondelegable, fiduciary duty, board members cannot vote by proxy.

Fiduciary Duties

All Board members owe fiduciary obligations to the Institute. The duty of care requires a Board member to be familiar with the organization’s finances and activities and to take part regularly in its governance. In carrying out this duty, Board members must act in good faith. In addition, Board members have a duty of loyalty to the Institute, requiring them to act in the interest of the organization and to avoid conflicts of interest. They also have a duty of confidentiality regarding Board deliberations. Board members are also charged with making sure the Institute follows applicable laws and regulations.

To meet their fiduciary obligations, Board members should prepare for Board meetings by reading the board books, attending Board of Director meetings, taking part in Board deliberations, representing their regions’ and chapters’ views and positions, and voting on Board matters.

Duties & Obligations

Other obligations of Board members include:

· Become familiar with the Institute’s By-Laws, policies, goals, and goals.

· Take part in Board meetings held in conjunction with the Annual Meeting of Members, the Annual Conference, and the Midyear Conference, and any other Board meetings held virtually.

· Fill a vacancy occurring among the Institute officers.

· Upon the recommendation of the Institute’s President, appoint an Executive Committee each year to oversee the day-to-day operations of the Institute.

· Approve necessary corporate resolutions, such as establishing bank accounts and signatories, and other corporate resolutions.

· Review and approve the Institute’s operating budget.

· Review and approve the Institute’s annual audited financial statements.

· Appoint and set compensation for the Institute’s Executive Director.

· Appoint the Institute’s certified public accountant to examine the records and financial statements of the Institute for the current fiscal year.

· Act prudently and responsibly in the best interests of the Institute.

Executive Committee

Function

The By-Laws provide that the Board shall appoint an Executive Committee to handle the day-to-day operations of the Institute, subject to oversight by the Board of Directors. The Executive Committee consists of 11 members of the Board, four (4) of whom are the President, Senior Vice President, Treasurer, and Secretary. The other seven (7) members are nominated by the President and approved by the Board. The President is chair of the Executive Committee.

Composition

The Board strives to ensure representation of all segments of TEI’s diverse membership on the Executive Committee. The Board thus adopted a resolution on March 26, 2006, stating that “in identifying candidates for appointment to the Executive Committee, the President shall give due regard to the desirability of achieving geographic and jurisdictional diversity, demographic factors including industry, race, and gender, and the candidates’ prior or current Institute experience and positions. No single factor shall be controlling, and no member shall be appointed (or precluded from appointment) solely on the basis of the person’s chapter, region, industry, or other attributes.

Meetings

The Executive Committee generally meets in person three times a year at the Annual Meeting of Members, Annual Conference, and Midyear Conference, and holds regular virtual meetings. Six members of the Executive Committee constitute a quorum for doing business. Executive Committee actions require a majority vote of its members constituting the quorum.

Powers & Duties

At a meeting held on October 3, 1965, the Board of Directors prescribed rules governing the powers and duties of the Executive Committee. The Executive Committee is empowered to act for the Board of Directors in all matters not involving change of policy at any time when the Board is not in session, except where governing law or the By-Laws specifically require action of the whole Board.

The Executive Committee may establish needed policies where none exists, subject to ratification by the Board of Directors.

Duties & Obligations

The Executive Committee may:

· supervise and regulate the operation of the Institute’s headquarters;

· authorize disbursements by the individuals who, by general or specific vote of the Board of Directors, have been authorized to sign checks;

· take required action concerning Institute employees and consultants, except that the selection of the Executive Director shall be a function of the Board of Directors;

· authorize the leasing of office space or termination of such leases; and

· take any action required in accordance with the specific delegation of authority by the Board of Directors.

The Executive Committee may not:

· elect persons to honorary membership or to receive any other award of the Institute;

· appoint the Nominating Committee, fill vacancies in its own membership, or fill vacancies in officers or directors of the Institute;

· designate the several standing committees or specify the duties of those committees;

· levy dues or other assessments on the members;

· authorize expenditures substantially departing from a budget previously approved by the Board; or

· adopt amendments to the Institute’s By-Laws or Chapter Regulations.

Officers

As provided in the By-Laws and by the Board, the Institute officers consist of President, Senior Vice President, Treasurer, Secretary, and Regional Vice Presidents.

The officers shall perform the duties usually performed by such types of officers, and such duties as may be assigned to them from time to time by the Board of Directors. The President or, in his or her absence, the Senior Vice President, shall preside at all meetings of members of the Institute. The President and Senior Vice President are both ex-officio members, without vote, of all committees of the Institute, except the Nominating Committee (of which they are regular, non-voting members). In the event of the inability or incapacity of the President to carry out the duties of the office, those duties shall be performed by the Senior Vice President.

The Institute’s staff performs a variety of tasks on behalf of the Treasurer and Secretary, subject to their review and approval. For example, the staff is responsible for overseeing the preparation of financial statements, subject to review by the Treasurer. The staff also prepares drafts of the minutes from Board and Executive Committee meetings. The Secretary, however, has ultimate responsibility for the minutes (including those from executive sessions at which the staff is typically excluded). Under TEI’s procedures, the Secretary prepares and submits a copy of all executive session minutes to the Institute’s independent auditors; in addition, a copy of all such minutes should be passed from one Secretary to his or her successor.

TEI has eleven regions and, hence, eleven Vice Presidents. Region 1’s Vice President, representing the Canadian chapters of the Institute, may be designated “Vice President-Region 1 (Canada)” or “Vice President for Canadian Affairs” when communicating with Canadian government officials.

All officers, including Regional Vice Presidents, are elected for one-year terms. Regional Vice Presidents are encouraged to serve a second, consecutive term (approved by Board on March 25, 2018). All other officers, including the Regional Vice Presidents, may stand for election to another term or terms in the same office, but must be elected to that office annually. The Board of Directors has the authority to increase or decrease the number of Regional Vice Presidents (or the Board of Directors generally), but a decision to decrease the size of the Board cannot remove an incumbent from office.

Any officer may simultaneously hold office as a chapter representative to the Institute Board and as an officer or director of any chapter.

Regional Vice Presidents

Function

In addition to being a member of the Board of Directors and officer of the Institute, Regional Vice Presidents are an important link between the chapters and the Board. Active performance of the duties set forth below is essential, and the Nominating Committee must take a candidate’s commitment to these responsibilities— including the ability to attend Board meetings — into account in its deliberations.

Regional Vice Presidents are responsible for ensuring adherence to, and effective implementation of, TEI policies and programs, as well as the Institute’s goals and objectives, at the regional and chapter level. Upward communication is important to the continuing effectiveness of TEI, and the Regional Vice Presidents are responsible for providing input to the Institute on the needs and views of the grassroots organization.

Chapters and regions have the discretion to reimburse the expenses of their Regional Vice President to attend Board meetings.

Scope

Regional Vice Presidents carry out established TEI policies and implement Institute goals as directed by the Board and Executive Committee. Their authority and responsibility extend to the chapters within their respective regions, as well as that inherent in their positions as officers of the Institute and members of its Board.

Regional Vice Presidents may start any program consistent with, or to further, Institute policies and programs, and they are responsible for monitoring chapter activities to make sure such activities are compatible with Institute policies and programs.

Because of their position, Regional Vice Presidents have authority to bind the Institute (and the chapters within their respective regions) regarding regional programs. Generally, however, no contract involving the expenditure of $5,000 or more of Institute (including regional and chapter) funds should be executed before the contract is reviewed by the Executive Director or his or her designee.

General Duties

· Affirmatively and effectively convey to the chapters the policies and programs of the Institute and of the current administration to promote understanding and active support of the Institute. The size of the Institute makes it essential that the Regional Vice President act as the representative of the President. To facilitate communication, Regional Vice Presidents should regularly contact chapter presidents and chapter representatives within their regions. Regional Vice Presidents should also consult with the President, Senior Vice President, Treasurer, Secretary, and Executive Director as necessary to perform their duties.

· Obtain from the chapters their views on Institute programs, policies, and recommendations for new emphasis or direction in Institute activities. Provide feedback promptly to the President, Executive Director, and other affected and responsible parties.

· Serve as a means of communication to and from the chapters when quick action is required, e.g., a legislative or administrative position of important concern, a consensus on a broad Institute matter, or the need for participation in an educational or other Institute activity.

· Give the chapters guidance on the conduct of their activities. Maintain contact with TEI about specific or current matters to be covered with a particular chapter.

· Provide the Institute (Senior Officers, the Board on which they serve, and staff) with information on chapter operations, any problem areas, and experiences, techniques, etc., used by a chapter that may be helpfully emulated by others.

· Meet with chapter presidents of the region, individually or as a group, to establish and maintain rapport and a working relationship and to assure that the plans and programs for the year are substantive and prepared for implementation. The Leadership Foundations Seminar in June is one forum for these regional discussions. The Annual Meeting of Members, Annual Conference, and Midyear Conference present other opportunities.

· Identify future leaders and, in connection with the Institute Nominating Committee (see Section 1 of Article V. Nominations of the By-Laws), chair a caucus of chapter representatives (Institute directors) from the region to select the region’s member and alternate to the Institute’s Nominating Committee.

· Promote the Institute’s educational programs throughout the region.

· Perform any special responsibilities assigned by the President of the Institute.

· Develop and circulate a regional newsletter to the chapters within the region, with copies to other Institute officers and the Executive Director.

· Encourage chapters to sponsor scholarships under the Board-approved guidelines.

· File required reports, including the Regional Vice President report requested for the Board of Directors meetings at the Annual Meeting of Members, Annual Conference, and Midyear Conference. These reports should reflect regional activities between Board meetings.

· Maintain a regional administrative file, which shall be given to the succeeding Regional Vice President at the end of the term of office. This file will help with the briefing process and ensure a smooth transition.

Collecting Chapter Feedback and Reporting to the Board

TEI’s Senior Officers will occasionally pose questions to Regional Vice Presidents aimed at soliciting feedback from chapters on topics and issues of interest to the Institute and to further its goals. The feedback received will help inform Board discussion on Institute initiatives and provide “closer to the ground” intelligence on what members are thinking. Questions and issues will vary year over year and will depend on a broad range of market factors.

Regional Vice Presidents are responsible for soliciting feedback from their chapters in response to the questions posed to them, as well as collecting feedback from their chapters and presenting it to the Institute Board generally. A designated part of each in-person Board meeting will be used for a report out and discussion led by the Regional Vice Presidents.

Meetings, Conferences, and Liaison Activities

· Organize regional conferences and make sure participating chapter responsibilities and duties are understood and agreed to, that Institute standards and requirements are met, and that TEI is appropriately involved. (See comment on the review of contracts in the Regional Conferences section of this Manual.)

· Take part in Board of Directors meetings held at the Annual Meeting of Members, the Annual Conference, and the Midyear Conference, plus any virtual meetings of the Board.

· Review the material sent out before the Board Meetings; come prepared to discuss your region’s perspectives on the issues raised in the materials; be ready to raise any additional issues of concern to your local chapters; and be a good conduit of communication by obtaining feedback from the chapters before the Board meets and report back on Board activities.

· Take part in the Leadership Foundations Seminar held in June. This is an excellent opportunity for the incoming and outgoing Regional Vice Presidents to interact and share ideas and accomplishments, and for incoming Regional Vice Presidents to build rapport with the chapter presidents in their regions.

· Schedule visits to the chapters within the region, ask for the opportunity to talk to chapter members at meetings and programs, and report on Institute-level activities and programs and on the regional conference.

· Encourage chapters to schedule liaison meetings with representatives of both national and subnational tax authorities and encourage the interaction between chapter committees and their Institute-level counterparts.

· Plan, organize, and manage liaison meetings with pertinent government officials, and help with the scheduling of meetings between industry and sub-industry representatives and their counterparts. Regional Vice Presidents for the United States frequently coordinate with the Internal Revenue Service and LB&I Division; the Region 1 Vice President is responsible for the Canada Department of Finance, Department of Justice, and Canada Revenue Agency liaison meetings; the Region 11 Vice President is responsible for liaison meetings with taxing authorities in Europe and Asia.

· Be active in raising advocacy issues on which TEI should work.

Financial Duties

· Make sure the chapters within their region file all required reports, such as annual financial reports, with TEI.

· At the end of the fiscal year, send a completed regional financial report to TEI. The form for this report is provided by TEI’s staff and should be given to staff by July 31 for use by TEI’s certified public accountants in preparing TEI’s financial statements and its not-for-profit information return (Form 990), which is due November 15. In addition, a copy of all tax returns filed for the region (if any) must be forwarded to staff.

· TEI maintains its books and records on an accrual basis, using a June 30 year end. Regional and chapter reports may be prepared on either a cash or accrual basis so long as they are prepared consistently. Anticipated material expenditures should be noted in an attachment to the report, even if reports are filed on a cash basis. Funds held either by the region or by the chapter hosting the regional conference (this practice varies from region to region) should be transferred (with an accounting) to the next Regional Vice President or the host chapter, whichever the case may be be.

See comment on review of contracts in the Regional Conferences section of this Manual and the Institute Investment Policy.

Chapter Representatives

Function

As a member of TEI’s Board of Directors, Chapter Representatives provide a vital link between the chapters and the Board. Active performance of the duties set forth below is essential, and each chapter’s Nominating Committee should take a Chapter Representative candidate’s commitment to these responsibilities into account — including the ability to attend Board meetings — in determining who will represent the chapter on the Institute’s Board. Chapter Representatives are responsible for ensuring adherence to, and effectively implementing, TEI policies and programs, as well as the Institute’s goals at the chapter level. Upward communication is important to the continuing effectiveness of TEI, and Chapter Representatives are responsible for providing input to the Institute on the needs and views of the grassroots organization.

Chapters have the discretion to reimburse the expenses of their Chapter Representative for attending Board meetings.

Scope

Chapter Representatives carry out established TEI policies and implement Institute goals. Their authority and responsibility are inherent in their positions as Board members. Board members who are Chapter Representatives are responsible for representing their chapters on the Institute’s Board, as well as monitoring chapter activities to make sure such activities are compatible with Institute policies and programs.

General Duties

· Affirmatively and effectively convey to their chapter the policies and programs of the Institute and of the current administration to promote understanding and active support of the Institute and its goals. The size of the Institute makes it essential that Chapter Representatives act as the representative of the President to their chapters. To help with communication, Chapter Representatives should maintain regular contact with their chapter’s president and other officers. They should also consult with the Institute’s officers and Executive Director as necessary to perform their duties.

· Obtain from their chapter members their views on Institute programs and policies and recommendations for setting priorities for Institute activities. Provide feedback promptly to the President, Executive Director, and other affected and responsible parties.

· Serve as a means of communications to and from the chapter when quick action is required, e.g., a legislative or administrative position of important concern, a consensus on a broad Institute matter, or the need for participation in an educational or other Institute activity.

· Give the chapter guidance on the effective conduct of their activities. Maintain contact with TEI about specific or current matters to be covered with the chapter.

· Provide the Institute (Senior Officers, the Board, and staff) with information on chapter operations; any problem areas; and experiences, techniques, etc., used by a chapter that may be helpfully emulated by others.

· Meet with chapter officers to establish and maintain rapport and a working relationship and assure that the plans and programs for the year are substantive and prepared for implementation.

· Work with their Regional Vice President to identify qualified candidates for office and to ensure smooth communications within the chapters in their regions. Caucus with the Regional Vice President to confirm a representative and alternate to serve on the Institute’s Nominating Committee.

· Work with chapter officers to identify and develop future leaders of the chapter. Identify and serve as a mentor to future leaders of the chapter.

· Promote the Institute’s educational programs throughout the chapter.

· Perform any special responsibilities assigned by the President of the Institute.

· Encourage chapters to sponsor scholarships under Board approved guidelines.

· Maintain a chapter administrative file, which shall be given to the succeeding Chapter Representative, at the end of the term of office. This file will help with the briefing process and ensure a smooth transition.

Meetings, Conferences, and Liaison Activities

· Take part in the organization of chapter events and make certain that chapter responsibilities and duties are understood and agreed to, that Institute standards and requirements are met, and that TEI is appropriately involved.(See comment on the review of contracts by TEI in the Chapter Conferences & Meetings

· Take part in TEI Board of Directors meetings held at the Annual Meeting of Members, Annual Conference, and Midyear Conference, plus any virtual meetings of the Board.

· Review the material sent out before the Board Meetings: (i) come prepared to discuss your chapter’s perspective on the issues raised in the materials; and (ii) be a good conduit of communication by obtaining feedback from the chapter before Board meetings and reporting back on Board activities.

· Take part in the Leadership Foundations Seminar held in June. This is an excellent opportunity for the incoming and outgoing Chapter Representative to interact and share ideas and accomplishments, and for incoming Chapter Representatives to build rapport with the chapter presidents and Regional Vice Presidents.

· Ask for the opportunity to talk to chapter members at meetings and programs, and report on Institute-level activities and programs and the regional conference.

· Encourage chapters to schedule liaison meetings with representatives of both national and subnational tax authorities and encourage the interaction between chapter committees and their Institute-level counterparts.

· Be active in raising advocacy issues on which TEI should work.

See the Collecting Chapter Feedback and Reporting to the Board section of this Manual.

Financial Duties

· Make sure the chapter files all required reports with TEI.

See comment on review of contracts in the Regional Conferences section of this Manual and the Institute Investment Policy.

Institute Staff

The Institute’s offices are located in Washington, DC, and are managed by an Executive Director appointed by the Board of Directors. The Executive Director has ultimate responsibility for overseeing the staff and all administrative functions of the Institute — including processing membership applications, issuing statements for dues, issuing notices of meetings of the Board of Directors and Executive Committee, properly accounting for all monies received and paid, planning and overseeing Institute programs and events, and handling all other administrative matters.

In addition to these administrative duties, the Executive Director shall:

· maintain cordial working relations with federal, state, and provincial tax administrators, related government agencies, and elected officials and their staffs;

· represent and act as the spokesperson for TEI as directed by the President;

· provide channels for members of TEI who, in the discharge of TEI committee or other TEI duties, must deal personally with government officials or bodies;

· prepare and release to appropriate media reports on Institute elections, educational programs, and advocacy activities, and all other newsworthy information relating to TEI; and

· establish and maintain good communications between the Institute’s Board of Directors and officers, regions, and chapters, and between the Institute committees and their counterparts at the chapter level.

The duties of the Executive Director and staff with respect to conferences and the work of committees are described in the sections dealing with those activities.

The Institute’s staff is organized into departments that perform various functions:

· Legal Staff — Serves as technical assistants to the President and Standing Committee Chairs (including the committees focused on internal TEI matters); monitors pending and proposed tax legislation, regulations, and other tax administrative and judicial pronouncements; oversees the preparation of position papers, liaison meeting agendas, and testimony; prepares communications for TEI publications (both print and electronic); liaises with government representatives; and develop educational content and programming for Institute events. Members of the legal staff are also frequently assigned special projects.

The Legal Staff also oversees legal and compliance activities for TEI, TEI Education Fund, and the chapters and regions, including reviewing contracts, ensuring compliance with corporate filing requirements, and monitoring chapter sponsorship and scholarship programs.

· Sponsorship – Responsible for identifying new sponsors, managing sponsor relationships, and administering sponsor benefits and accounts. Serves as the liaison between sponsors and the Institute, regions, chapters, and members. Administers the Chapter | Sponsor Connection Portal and the Thought Leadership Bulletin.

· Governance & Operations – Responsible for the day-to-day administrative operations at the Institute headquarters, including office management, governance, human resources; oversees TEI’s external accounting function; oversees TEI’s annual financial statement audit; coordinates chapter and regional financial reports; administers chapter rebates, 1099 reporting, and tax filings.

· Events — Responsible for planning, coordinating, and managing all in-person, Simulive, and virtual Institute conferences, seminars, courses, and governance meetings. Responsible for securing continuing professional education (CPE) accreditation for TEI.

· Marketing & Communications – Responsible for all forward-facing marketing and communications; maintaining TEI’s website, event sites, and social media accounts; and producing printed and electronic promotional materials for membership, educational programs, and events.

· Membership & Chapter Engagement – Responsible for overseeing the operations of TEI’s membership and chapter services, including processing member applications and renewals, monitoring communications on TEI’s online community, providing support and training to chapter leaders, and communicating chapter and member information updates.

· Information Technology/Web Services – Coordinates, implements, and maintains TEI’s IT systems and services that make essential data and technology solutions available to the rest of the organization. Manages and maintains TEI’s technology infrastructure, including its association management system, internal network, cloud assets, and data/network security. Manages the technical side of TEI’s websites. Trains staff and members on the organization's IT resources. Helps with the setup and coordination of TEI’s virtual events and online education.

Following is an organization chart setting forth the Institute's staff:

Indemnification of Officers, Directors, and Employees

The Institute’s By-Laws state that the Institute may reimburse its officers and directors for actual expenses when authorized by the Board of Directors. The Board of Directors has adopted a resolution to reimburse its officers, directors, and employees for reasonable expenses incurred to perform their duties for the Institute to the full extent permitted under applicable law and the Institute’s insurance policies. The indemnification policy does not require automatic coverage of specific acts but allows the Board to reimburse an individual for legal and other expenses. (Approved, March 28, 1992.)

The Institute currently maintains a $5 million Directors and Officers Liability policy, a $2 million commercial General Liability policy, and a $10 million Umbrella policy.

Membership

Membership Categories and Guidelines

TEI’s By-Laws provide four categories of membership: full membership, student membership, emeritus membership, and honorary membership. The Board of Directors has approved Membership Guidelines for the Institute’s Membership Committee.

Membership Categories and Guidelines

Full Membership

The Institute’s policies and procedures relating to Full Membership are in Article I, Section 1(i) of the By-Laws.

Full membership shall be open to people not engaged in public tax practice who are employed by corporations or other businesses and who are charged with responsibility for directly or indirectly administering the taxation of their organization.

Administering the Taxation of Their Organization

The Membership Committee has determined that whether an applicant for membership administers the taxation of their organization shall be interpreted broadly, and shall include individuals involved in the administration of the company’s accounting, finance, tax technology, unclaimed property, and other tax-related matters.

Public Tax Practice

The Board of Directors has interpreted the phrase “not engaged in a public tax practice” to mean that neither the individual nor the corporation or other business that employs him or her may be engaged in a public tax practice. Hence, an individual employed in the tax function of a law or accounting firm engaged in a public tax practice is not eligible for membership. (Approved, October 13, 1984.)

On March 15, 1997, the Board interpreted the phrase “not engaged in public tax practice” to deny membership to an applicant who was part of an organization that included a public accounting firm, even though the applicant himself was not engaged in public tax practice. The applicant was an associate partner in a consulting firm that was a business unit of an enterprise that had, as a separate business unit, a public accounting firm engaged in a public tax practice. The Board concluded that the accounting firm’s public tax practice should be attributed to the other business units (and hence to the applicant) because of a cost-sharing arrangement between the business units, the coordination of their marketing efforts, and their joint efforts to coordinate training and protect their common trade name.

Following the Board’s 1997 decision, a task force on membership requirements was established to thoroughly review the Institute’s Membership Guidelines. On March 21, 1998, the Board accepted the report of the task force, which confirmed the previous interpretation of the “not engaged in public tax practice” rule as it applies to employees of law and accounting firms. In December 2000, the Executive Committee confirmed a Membership Committee interpretation that the “public tax practice” of entities owned by an enterprise would not automatically be ascribed to the enterprise and, therefore, to the employees of that enterprise. In other words, the attribution (or taint) rule adopted by the Board in 1997 applies down and across, but not up, the ownership chain.

On March 21, 1998, the Board adopted a recommendation that individuals employed by enterprises that sell tax-related or ancillary products or services (such as appraisal services or tax computation software) need not be denied membership per se. Such applicants must be responsible for preparing the corporation’s tax affairs and may not advise or take part in the selling of such products or services. Members of such companies must be bound by a non-solicitation standard and a duty of professionalism. Accordingly, the Board adopted the following standard of conduct:

The member will at all times recognize a duty of professionalism and will not use TEI membership to solicit business from or sell products to other members.

Tax related and ancillary products and services are considered to include tax insurance, tax credits and incentives, tax technology products and services, and valuation services.

Profit-oriented business